Supply Shocks creates Inflation; China gets it but we sure don’t

Bernanke & Blanchard shows supply shocks — not tight labor markets — drove inflation. The prescription? Create unemployment anyway. Seriously, WTF

While the Fed prepares to engineer joblessness and despair to fight yesterday's supply-driven inflation, Trump's new tax bill would actively create tomorrow's supply shocks — raising electricity costs by $400 per family while destroying renewable energy jobs.

The Research That Exonerates Workers

In a comprehensive 35-page analysis published by the American Economics Association, former Fed Chair Ben Bernanke and economist Olivier Blanchard meticulously documented what really drove the pandemic-era inflation surge. Their findings should have vindicated workers who bore the brunt of criticism from inflation hawks.

The data tells a clear story: Energy price shocks accounted for the lion's share of inflation's rise in late 2021 and early 2022 — and "essentially all" of its decline in the second half of 2022. When Russia invaded Ukraine, energy prices spiked further. When those shocks reversed, inflation fell. The correlation was unmistakable.

Labor markets? They actually contributed negatively to inflation in 2020 and early 2021. Even by 2023, after two years of supposed "overheating," tight labor markets remained "by no means dominant" as an inflation source. The feared wage-price spiral never materialized, workers couldn't even achieve nominal wage gains sufficient to maintain their purchasing power according to their own research!

The smoking gun: Sectoral shortages peaked in 2021:Q3, precisely when automobile production hit its trough (falling 25% to under 9 million units annually), inventories reached record lows, and Google searches for "chip shortage" and "car shortage" exploded. The supply constraints were visible, measurable, and temporary.

The Contradiction at the Heart of Fed Policy

This part broke me, I cannot even stomach this disgusting recommendation. Despite this evidence, the paper's prescription remains orthodox: reduce the vacancy-to-unemployment ratio from current levels to 1.2, potentially pushing unemployment above 4.3%. If this was a matter of excess cash in the system, then they would have a point, but they admit this isn’t the case. The authors acknowledge this would require "achieving a better balance of labor demand and supply" — economist-speak for reducing capital expenditure by the way that would increase production to handle inflation long term throwing people out of work, which often means the destruction of these people’s economic futures, and in some cases their lives.

The dishonesty, to the point I am I struggling not to call it depravity, is breathtaking. After proving that commodity prices, supply chain disruptions, and sectoral shortages drove inflation. They still recommend the same medicine: unemployment. It's as if a doctor diagnosed food poisoning but prescribed chemotherapy because that's what's in the medical textbook.

The Human Cost Already Mounting

This prescription ignores the suffering already visible in labor markets. Long-term unemployment — defined as joblessness lasting 27 weeks or more — has surged to 23.5% of all unemployed workers, the highest level in three years. These aren't statistics; they're people watching their savings evaporate, their career momentum stall, their retirement dreams recede.

The housing market tells its own story of middle-class dreams deferred. Despite the good work of YIMBYs getting rid of zoning and trying to make it easier to expand housing supply. The insufferable rate increases since 2022 work to suppress new housing starts lower and lower. With 30-year mortgage rates stuck between 6% and 7% (double their 2021 lows), the median home now requires over a full year of household income for a down payment. Monthly mortgage payments consume 35% of the median household's income — a level that would have been considered predatory lending a generation ago.

Now Trump's Bill Makes Everything Worse

As if workers haven't suffered enough from being blamed for inflation they didn't cause, Trump's "One Big Beautiful Bill" promises to recreate the very supply shocks that triggered the crisis — while destroying jobs in the industries that could solve it.

The legislation would slash renewable energy capacity additions by 72% over the next decade through a toxic combination of:

Phasing out wind and solar subsidies by 2027

Imposing new excise taxes on renewable projects using Chinese inputs (which most do)

Curtailing support for domestic manufacturers of solar panels, wind turbines, and batteries

The cruel irony is perfect: After energy shocks drove inflation, and after punishing workers who had nothing to do with it, politicians now want to create new energy shocks by sabotaging the very industry that could prevent future ones.

The cost to families: Studies show ending renewable tax credits alone could push the average family's energy bill up by $400 per year within a decade. This from the party that claimed to care about the cost of living.

Even more perversely, the bill undermines America's tech industry just as it needs massive amounts of new electricity for data centers. With natural gas plants facing years-long backlogs and nuclear taking forever to build, renewables are the only quick solution. By throttling them, Trump's bill hands technological leadership to China on a silver platter.

New Supply Shocks on the Horizon

Meanwhile, fresh supply disruptions loom. The 12 day war has ratcheted Iran-Israel-American tensions to new heights, with Iran threatening to close the Strait of Hormuz during the war — the chokepoint for 20% of global oil trade. While the crisis cool for now, it is become increasingly clear it isn’t over. Energy analysts now assign a non-trivial probability to oil spiking above $100/barrel, potentially reigniting the very inflation the Fed claims to be fighting.

The absurdity compounds: The Fed prepares to create unemployment to fight yesterday's supply shocks, Trump's bill actively creates tomorrow's supply shocks, and new geopolitical risks threaten even more supply shocks — yet workers will pay the price for all of it.

China's Alternative Path

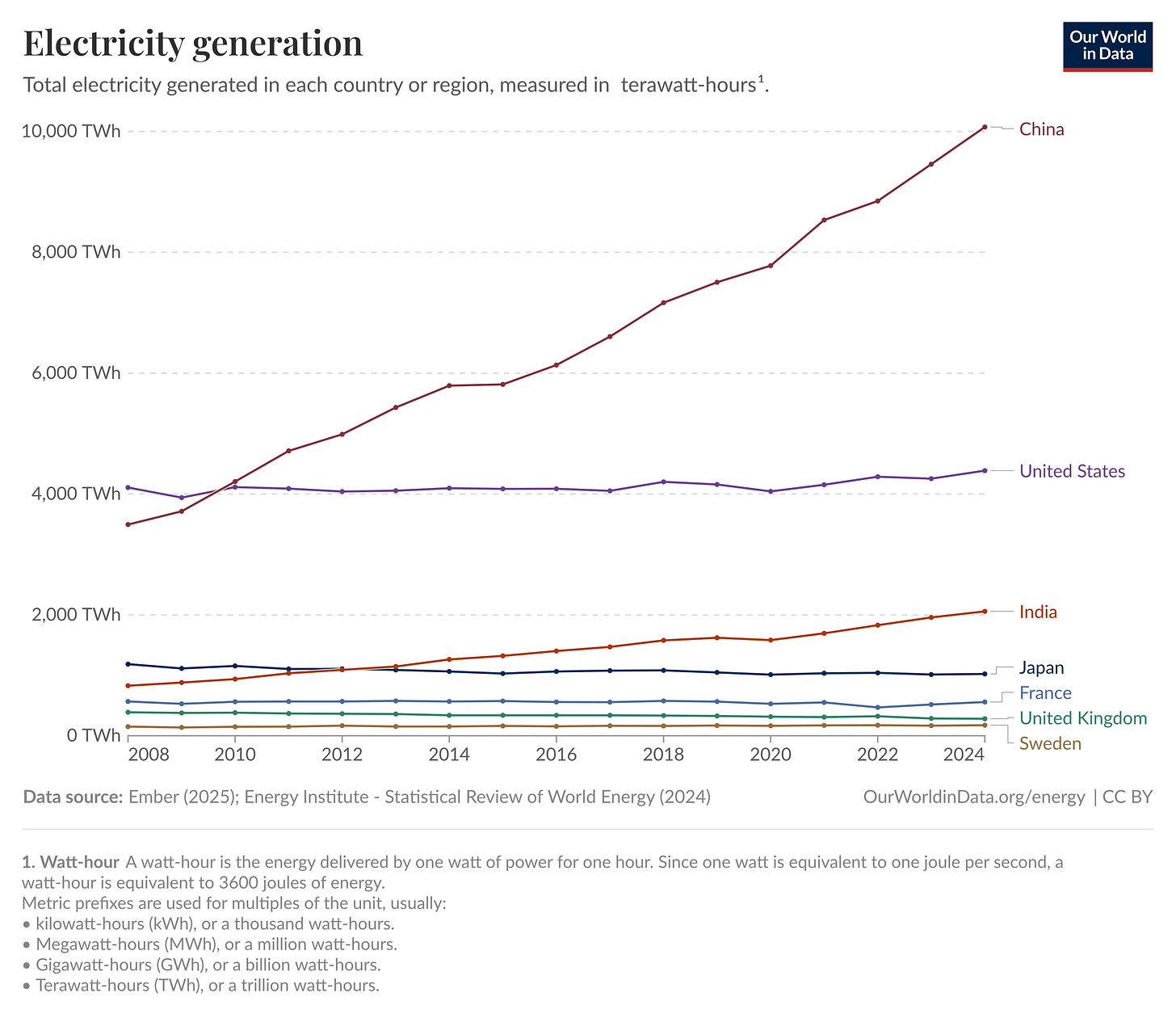

While American policymakers compete to see who can inflict more damage on workers and consumers, China is attacking the actual problem with stunning efficiency. In May 2025 alone, China installed 93 gigawatts of solar capacity — equivalent to Poland's entire electricity generation. They added 26 GW of wind power, roughly 5,300 turbines spinning up in a single month.

The scale defies comprehension. Between January and May, China added enough renewable capacity (198 GW solar, 46 GW wind) to power Indonesia or Turkey. Their total installed solar capacity now exceeds 1,000 GW — half the world's total.

This isn't just about climate goals. It's about energy security and price stability. By dramatically expanding energy supply, China directly addresses the constraints that Bernanke and Blanchard identified as inflation's primary driver. No unemployment required. No artificial energy scarcity created.

China's central bank seems to understand this. Despite facing similar global pressures, the People's Bank of China kept lending rates steady at 3.0% (one-year) and 3.5% (five-year). Officials express "strong degree of satisfaction" with their current stance. They're building solutions, not creating new problems.

Cruelty, At The Expense of Economic Power, Is Compounding

Workers face a perfect storm of policy failures:

Already happening:

Fed engineering unemployment (especially long term unemployment) to fight inflation that workers didn't cause

Long-term unemployment at 3-year highs

Housing unaffordable with mortgages consuming 35% of income

Real wages still below pre-pandemic levels

About to happen:

$400 annual energy cost increases from Trump's bill

Millions of renewable energy jobs destroyed

New supply constraints from throttled clean energy production

Potential oil shocks from Middle East tensions

Potential shocks coming from rare earth metals

Bottomline

The Bernanke-Blanchard paper admits that workers didn't cause inflation. Energy shocks and supply constraints did, with more economists and politicians are *forced* to admit this . Yet the Fed prepares to punish workers with unemployment anyway. Now Trump's bill promises to recreate the very energy shocks that caused the problem while destroying jobs in the industries that could prevent future ones.

It's a deliberate choice to make innocents pay twice: first for inflation they didn't cause, then for politicians' refusal to address its actual sources. While some like YIMBYs are addressing causes of housing inflation, and antitrust are trying to deal with the whole cartel issue. If the cost of capital is high, capital expenditure keeps decreasing, and it’s harder and harder for people to find a job after a layoff. What do you think is going to happen?

The cruelty, it seems, is not a bug but a feature of American (and Western considering how god damn thirsty European politicians are for austerity, especially the British) economic policy — this universal agreement that innocents must suffer and look for any excuse to punish them, while China is building up capacity and actual economic power.