Institute For Family Studies: Cash For Kids Works

Global evidence proves pronatal policies boost birth rates

Expanding America's Child Tax Credit would increase birth rates by 3-10%, potentially adding 5-35 million Americans by 2100, according to Lyman Stone new report for the Institute for Family Studies. This contradicts the common (and wrong) view that financial incentives don't significantly affect fertility decisions. Read the full report on their website. Short on time? My summary below gotcha covered!

Why it matters: U.S. fertility has plunged below 1.6 children per woman, threatening future economic growth and social stability. While economists and pundits alike share Leonard Lopoo’s view in his Wall Street Journal article that baby bonuses are "costly and ineffective," merely shifting birth timing without increasing family size, extensive global evidence demonstrates otherwise.

The big picture: Financial incentives demonstrably increase fertility rates when systematically implemented. A benefit increase worth 4% of GDP per capita per child typically boosts birth probabilities by 1% — modest per policy but compounding dramatically over generations.

The research evidence

Academic studies find consistent effects:

Analysis of 43 studies covering 58 cash incentive policies shows clear correlation between benefit generosity and fertility increases

A $1,000/year child allowance (worth about $13,000 in present value or 15% of GDP per capita) would likely increase births by 2-5%

The 17 countries implementing major pronatal policies since 2000 saw fertility increases of 0.09-0.18 births per woman in difference-in-differences analysis

The full list of policy-implementing countries studied includes: Estonia, Australia, New Zealand, Czechia, Mongolia, Russia, Latvia, Japan, Bulgaria, South Korea, Armenia, Romania, Hungary, Canada, Poland, Lithuania, and Slovakia

Event-study framework analysis confirms a clear change in fertility rates after pronatal policies are implemented, with effects persisting 10+ years later

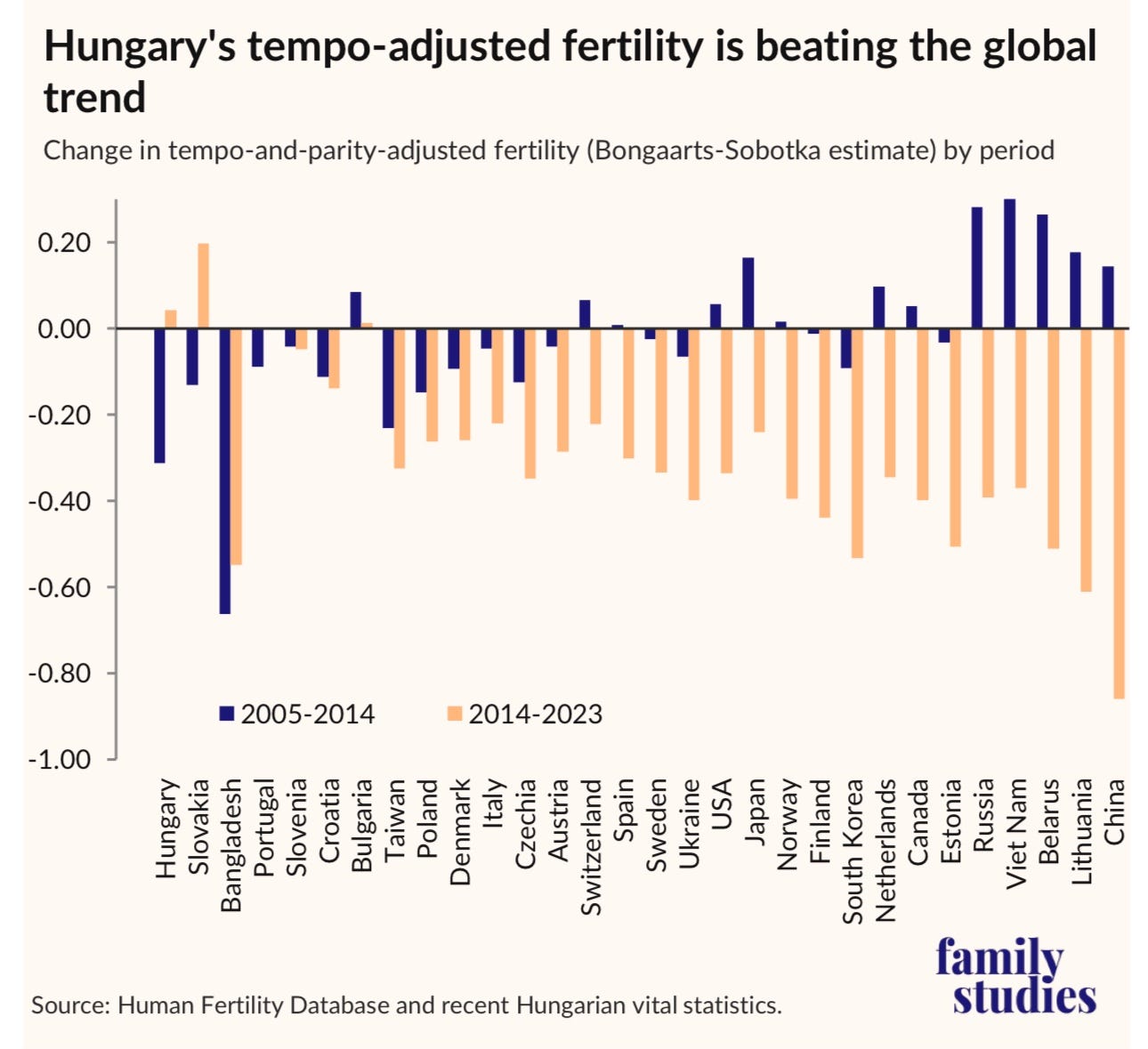

Only Hungary and Slovakia have shown increases in tempo-and-parity-adjusted fertility (which accounts for birth timing effects) since 2014, while most nations continue declining

Hungary: The pronatal success story

Hungary's fertility rose from 1.25 in 2012 to 1.52 in 2022 after implementing:

Constitutional protection of marriage (2012)

Marriage bonuses

Family Housing Support Program/CSOK program subsidizing home loans for young families

Expanded cash benefits (with more added in 2024)

Reality check on spending: The Hungarian government claims to spend 5% of GDP on family policy, but OECD calculations show Hungary spends only 2.3% of GDP (1.3% on cash benefits) — comparable to Canada. The Hungarian government's own statistics portal shows just 1.1% of GDP spent on "family benefits."

Why it works anyway: Hungary's flagship CSOK program serves multiple functions beyond boosting births — ensuring a liquid forint-denominated mortgage market and replacing Soviet-era housing.

Mongolia: Cash benefits drive fertility changes

Mongolia's fertility rate increased dramatically from about 2.0 in 2006 to nearly 3.0 by 2014 after implementing and expanding cash benefits for births in the 2000s:

Synthetic control modeling shows Mongolia's fertility would have continued declining to about 1.6 children per woman without these interventions

When benefit values were allowed to depreciate in recent years, fertility began declining again, dropping to around 2.8 by 2022

The clear pattern shows fertility rising when benefits are implemented (2006), expanding further when benefits increase (2009), and falling when benefits lose value

Clear causality: Mongolia's case provides one of the clearest demonstrations of direct fertility responsiveness to financial incentives, with a nearly 50% increase in fertility rate compared to what would have occurred without intervention.

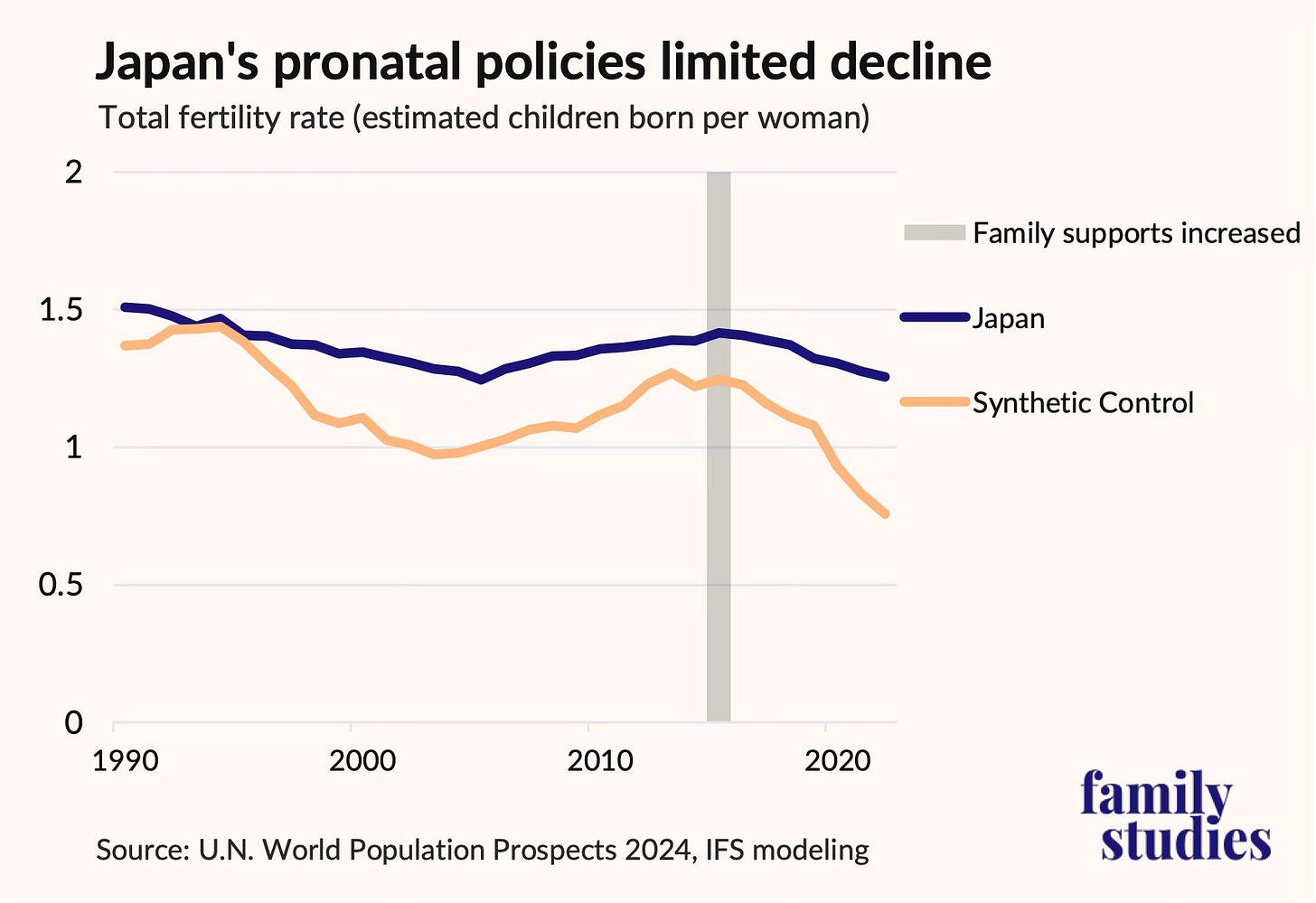

Japan: Mitigating decline

Japan implemented major family support increases in 2010 with measurable effects:

Japan's fertility would have plummeted from about 1.4 to 0.8 children per woman without intervention, according to synthetic control modeling

Instead, Japan maintained fertility around 1.3-1.4 through 2022

The gap between actual fertility and the synthetic control grows progressively wider after 2010, reaching about 0.5 children per woman by 2022

This represents a 60% higher fertility rate than Japan would have experienced without policy intervention

Practical lesson: Japan demonstrates that even when people say that “cultural and economic forces driving fertility decline are too powerful”, even limited pronatal policies can substantially mitigate negative demographic trends, preventing catastrophic population collapse.

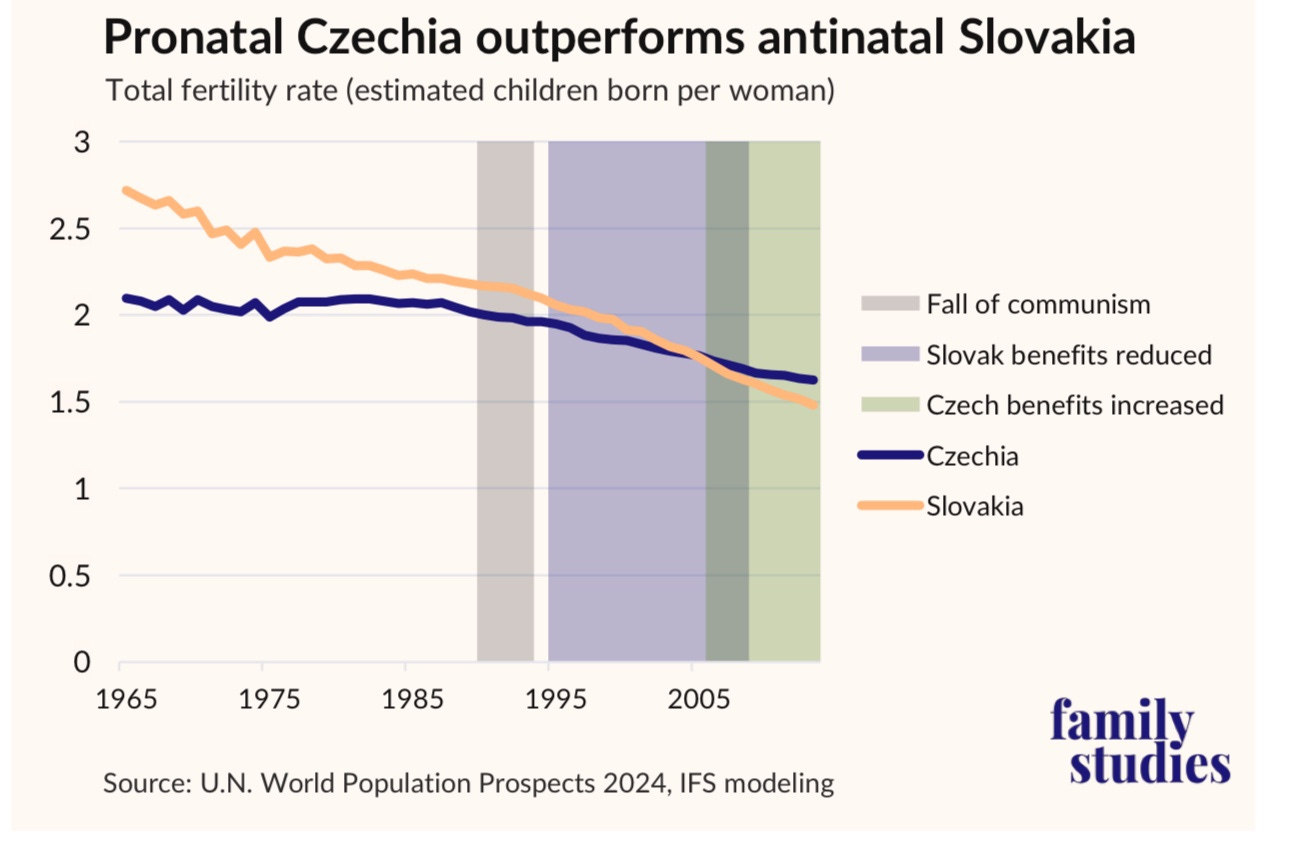

Czechia vs. Slovakia: The natural experiment

After Czechoslovakia's breakup in 1993, these virtually identical countries diverged in family policy:

Both reduced family spending through the mid-1990s

Slovakia cut more aggressively while Czechia maintained steadier support

Czechia expanded benefit generosity during 2005-2008 and again in 2018

Slovakia's family spending continued falling until 2008 with no major increase until 2018

The results for completed fertility (measured at age 40):

For cohorts turning 30 between 1980-1993, Slovak women averaged 0.17 more children than Czech women

For the 2013 cohort (measured at age 40 in 2023), Czech women averaged 0.14 more children than Slovak women

This represents a 0.31 swing in completed fertility advantage, directly corresponding to changes in family policy generosity

Why it's compelling: This natural experiment controls for many cultural and historical variables. Czechs are less religious than Slovaks, have higher incomes, and marry later — all factors that people would say lower fertility, yet the opposite occurred as Czechs have higher rates than Slovaks, demonstrating policy impact.

The timing effect: Why accelerated births matter

Even when policies primarily shift birth timing rather than increasing completed family size (approximately 1/3 of effect is on completed family size), this still creates substantial benefits:

Health advantages: Between ages 25-29 and 35-39, rates of eclampsia rise 15%, IVF usage 60%, breech presentations 42%, and NICU admissions 15%

Economic savings: Younger births reduce healthcare costs and infertility treatments

Career impacts: Research shows motherhood penalties stem from cultural norms, not timing

Preference alignment: 37% of women aged 25-29 want children within two years, yet only 17-20% achieve this

Demographic mathematics: Earlier births mean those children enter the workforce earlier, with each generation arriving sooner and overlapping more with subsequent generations

The IFS proposal: A pronatal Child Tax Credit

The Institute recommends:

Raising nonrefundable Child Tax Credit to $2,000 (from current $300, which reverts to $0 in 2026)

Increasing refundable Additional Child Tax Credit to $2,500 (from $1,700, which reverts to $1,000 in 2026)

Making credits claimable against payroll taxes (not just income taxes)

Indexing both to inflation using the PCE Deflator

How it works:

Phase-in rate of 15% means families need over $20,000 in income to fully claim their first child's credit, and over $40,000 for their second

For families with three children, the full refundable credit wouldn't phase in until they had over $75,000 in income

Low-income families can't obtain large benefits simply by having more children

At median household income ($88,000), a two-child family would receive a tax cut worth 6% of income

Marriage bonuses would reach 12% for low-to-moderate income households, extending further into middle incomes than current law

Work incentives would strengthen through lower implicit marginal tax rates for both married and unmarried parents

Cost and funding: The $200-350 billion annual cost exceeds current Congressional proposals but could be covered through:

Special excise taxes on pornography providers, social media companies, and gambling (similar to existing taxes on guns, gasoline, airline tickets, and tanning salons)

The federal government raised $375 million in gambling excise taxes in 2024 (at just 0.25% of wagers) versus industry revenues of $72 billion

Raising or removing the cap on incomes subject to payroll taxes (removing it entirely would yield $200-300 billion annually)

Reducing the phase-out threshold to $200,000 for married couples and $100,000 for singles (from $400,000/$200,000)

Bottomline

Multiple rigorous studies and international case examples prove cash-for-kids policies work, delivering demographic benefits that compound over generations while creating stronger families, healthier children, and better economic outcomes.

The IFS is bunk. Hungary's policies have been a failure. 1.25 to 1.5 and then trending downward is in no way a success. This is cracked and BS.